"The Importance of Adequate Liability Coverage in Condo Insurance" Can Be Fun For Everyone

Common Misconceptions about Condo Insurance Exposed

When it happens to condominium insurance coverage, there are actually a lot of mistaken beliefs that can lead property owners astray when it comes to defending their financial investment. Understanding the facts about apartment insurance is essential to make certain you have the best protection in location and that you are not recorded off guard in the occasion of an unanticipated event. In this post, we will definitely disprove some of the very most popular misunderstandings regarding apartment insurance policy.

Misconception 1: The Condo Association's Insurance Covers Everything

One of the most common misunderstandings about condo insurance policy is that the condo association's insurance coverage policy deals with everything within your unit. While it is true that the organization's expert plan generally covers popular regions and building outdoors, it does not stretch insurance coverage to your personal system or private possessions. As a condominium proprietor, it is essential to have a different insurance coverage plan particularly tailored to cover your device and private home.

Myth 2: Condo Insurance is Pricey

Another misunderstanding concerning condo unit insurance is that it is expensive. Nonetheless, this expectation might vary depending on numerous elements such as area, size of the device, and coverage limits. In fact, condominium insurance coverage can be quite inexpensive when compared to other styles of residence insurance coverage plans. Through shopping around and reviewing quotes from different insurance providers, house owners may discover competitive fees that go with their budget plan while supplying enough coverage for their specific needs.

Myth 3: Condo Insurance Only Deals with Property Damage

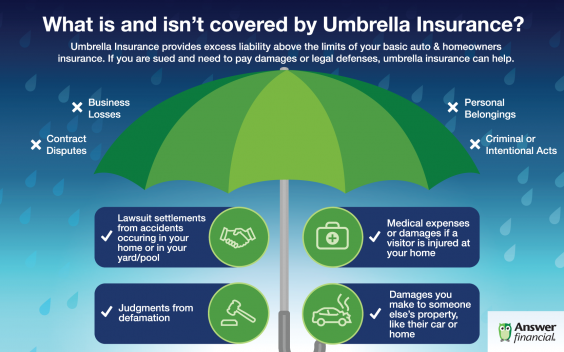

Many people erroneously feel that condo unit insurance policy only deals with property damages caused through activities like fire or water cracks. While safeguarding versus property damage is certainly a significant element of condo insurance coverage, there are various other important coverages consisted of as well. Condo insurance commonly includes responsibility protection which safeguards house owners in case someone gets harmed on their residential or commercial property and determines to file a claim against for harm or medical expenses.

On top of that, the majority of plans additionally give loss-of-use coverage which helps cover extra living expenses if your device becomes unliveable due to a covered event. This may consist of short-term accommodations and various other related costs until your device is fixed or switched out.

Mistaken belief 4: Condo Insurance is Unnecessary for Tenants

Numerous people who lease a condo unit mistakenly strongly believe that they do not need to have condo insurance coverage because they don't own the residential or commercial property. Nevertheless, while the property manager's insurance policy policy may deal with the design itself, it does not extend coverage to the occupant's personal belongings or obligation protection. Lessee's insurance policy, which is similar to condo unit insurance, deals with a occupant's private building and liability in instance of mishaps or damage within their leased system.

Mistaken belief 5: Condo Insurance Covers Flood Damage

One common misunderstanding is that condo insurance deals with flood damage. In reality, basic condo insurance coverage plans do not generally cover flooding harm led to by natural calamities such as storms or hefty storms. To guard against flood-related losses, house owners ought to consider purchasing separate flood insurance policy via the National Flood Insurance Program (NFIP) or personal insurance firms providing flooding insurance coverage.

False impression 6: Condo Insurance Deals with Expensive Jewelry and Artwork

While some high-value things might be covered under a regular apartment insurance policy policy, there are normally limits on coverage for jewelry, art work, and other useful things. If you possess pricey precious jewelry or art pieces that goes beyond these limitations, it is advisable to obtain added protection understood as "set up private building" insurance coverage. This makes sure that your useful ownerships are appropriately defended against reduction or damages.

In conclusion, understanding the truth behind common misconceptions about apartment insurance coverage is crucial for every apartment manager or occupant. Through disproving TMT Insurance and possessing proper expertise concerning what condo insurance covers and what it doesn't, people can easily create informed choices when deciding on their protection choices. Don't forget to consult along with an experienced insurance agent who may aid adapt a plan details to your requirements while dispelling any more misconceptions you might have concerning apartment insurance coverage.

Take note: Word count - 508 words.